This guest post is courtesy of Dean Mulally, Managing Director – IFA, UK & International at Mark Dean Wealth Management.

Investing in property seems the natural choice for many investors these days. But should you be buying actual bricks & mortar or are there smarter ways to invest in UK property?Obviously there’s the attraction of a steady income from the rent that the tenant hopefully pays, then there’s the potential for capital appreciation with house prices in the UK seemingly forever rising, but unfortunately, the story is not that simple.

When I meet with many of my clients that have property portfolios they tell me of the horror stories of tenants failing to pay any rent for months and the mounting legal bills they are incurring to get them out, whilst they are still paying a buy to let mortgage. Tenants that do move out sometimes leave it in a terrible state, constant cost of maintenance, rental voids where their agents can not find suitable tenants, on-going management fees to estate agents, legal fees for purchasing and selling, stamp duty increases etc, etc, etc.

You can now add a few more downsides to owning a rental property in the UK: from April 2015 non-UK residents no longer benefit from attractive tax advantages if they invest in UK residential property. Anyone currently holding property in the UK or considering future investment choices needs to think carefully about these tax changes.

What are the UK taxation changes?

Capital Gains Tax exemption removed: In November 2014, Her Majesty’s Treasury confirmed that non-residents will no longer be exempt from capital gains tax (CGT) on UK residential property gains. This came into effect on 6 April 2015, meaning gains from this date are chargeable at rates up to 28%. So you get to take 100% of the risk, yet only benefit from 72% of the gain.

Private Residence Relief restricted: The Treasury also announced that access to Private Residence Relief (PRR) will be restricted. From 6 April 2015, to claim PRR on a UK property a non-resident will need to live in that property for 90 nights per tax year of ownership.

Personal allowance for income tax removed: Currently for non residents, the first £10,600 pa of rental income is covered by the personal allowance. However, this allowance is to be withdrawn from 6 April 2017 unless 75% of your total income comes from the UK.

Don’t forget inheritance tax (IHT): There is a misconception that only UK domiciled individuals are subject to UK IHT. This is not the case; most assets in the UK, including residential property held by non-domiciled clients, are chargeable at the standard rate of 40% on assets above the current nil rate band of £325,000.

Do the maths!

Investing directly in residential property may feel like a low risk option, especially as you get a physical asset to show for your money, but property prices can go down as well as up. Property is generally illiquid, so selling quickly normally means accepting a lower price. Then there are rental voids (i.e. periods of time where the property is left vacant), plus legal fees for buying and selling. Also factor in estate agents’ fees, surveyors’ fees and maintenance costs. Sadly, many tenants do not respect your property as you would. Consequently, they leave you with a list of refurbishments to carry out, which means more expenditure before you can rent again.

From my experience you are doing well if you are yielding 4.5%pa in rental income after all costs are taken out. So for example, if you own a property worth £400k, then you should be expecting north of £18,000pa after all costs. If not, then perhaps you should be investing elsewhere without all the headaches.

You have to take the emotion out of it, this is a £400k asset/investment whatever way you look at it, and you need to take tough decisions if that £400k is not working hard enough for you.

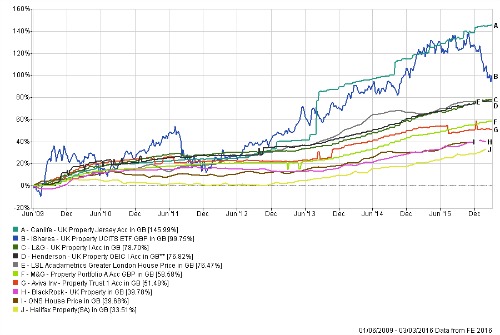

The chart below shows a comparison of average UK house prices over the past 8 years, according to several leading indices, such as the Halifax House Price index, Office of National Statistics (ONS) & Greater London house prices – versus the performance of several popular property funds:

What the chart shows is that London has seen a greater rise than the UK average, but the chart also displays how some funds have out-performed the direct property market, and they are daily traded funds, so you can sell and have the money in your bank account within days, as opposed to having to wait months when you sell a directly held property.

Let's look at the alternatives…

Investment in property funds: This is essentially a pooled investment, where you hold units or shares within a fund, which in turn invests in a portfolio of properties as opposed to you holding the physical asset itself.

This approach allows you greater diversification and is easier to sell if needs be, as most funds are daily traded, therefore creating a more liquid asset, without all the legal fees, maintenance costs and ongoing headaches. Investment funds continue to be tax efficient if you have been non-resident for over five years as investment gains would be exempt from Capital Gains Tax. You can also hold these types of fund within an investment bond which in turn defers any immediate liability to income tax.

Investment Trusts: This is where a fund manager runs a portfolio of properties which hopefully produce a rental income. Similar to a fund but the trust can leverage, i.e. borrow money. The trust issues shares and that share price will rise and fall according to supply and demand. One good example of this is the F&C Commercial Property Trust that holds a portfolio of properties all producing rental income (most are on very long leases with established companies) and the yield is currently 4.35%pa as it pays out 0.05p per share every month by way of a dividend. The capital value will obviously fluctuate day to day but over the longer term it should match the general property market as it directly owns property as its main asset. It does not issue more shares when a new investor comes along, so the price of the shares rises and falls according to demand, but the dividend stays the same as long as the underlying tenants continue to pay their rent.

Exchange Traded Fund: There are several different forms of an ETF, but they are basically a tracker fund that should virtually mirror a particular index, such as the UK house price index.

Investment in an international bond: Building an investment portfolio within an international bond wrapper can help to overcome some of the taxation issues highlighted above. All gains and most income within the bond are on a gross roll up basis, and tax only becomes liable when some or all of the bond is encashed. There are also Inheritance Tax advantages if the bond is held within a trust, helping to ensure assets are passed on to beneficiaries in a tax efficient manner.

The investment bond would hold any of the fund types mentioned above, making for easier administration and a whole host of different tax advantages.

Dean has over 30 years' experience in the financial services industry. Before establishing Mark Dean Wealth Management, Dean was Senior International Wealth Manager at HSBC International Financial Advisers (UK) Limited in London working out of their Canary Wharf headquarters and before that held a similar position at Citibank, also in Canary Wharf. Dean is a fully qualified Independent Financial Adviser (holding QCA Level 4 diploma status). Dean is also a member of the Personal Finance Society (PFS), Federation of European Independent Financial Advisers (FEIFA) as well as the Chartered Insurance Institute (CII). Find out more at markdeanwealthmanagement.com.