by David Kuenzi, CFP®, Thun Financial Advisors

2013 ushers in a series of substantial tax increases for all American taxpayers. These changes alter the landscape for efficient investment management and financial planning. Investors seeking to maximize long-term investment returns must factor these changes into their wealth management strategies. This is particularly true for Americans abroad because the 2013 tax changes coincide with other significant tax and compliance changes related to FATCA.

In this note, we review the major changes taking effect on January 1st 2013. Next, we identify aspects of the changes that uniquely affect Americans living abroad. We then discuss a range of possible investment planning strategies that can be applied to mitigate the impact of the new, higher tax environment faced by U.S. taxpayers living abroad.Major 2013 Tax Changes

The 2013 tax changes fall into four broad categories: 1) the extension, with modifications, of the “Bush tax cuts,” 2) the new “ObamaCare” taxes, 3) changes to the estate/gift tax, and 4) other tax increases.

Extension of the Bush Tax Cuts

The core element of the “fiscal cliff” deal struck by President Obama and the Republicans at the start of 2013 was the extension of the so-called “Bush tax cuts” with some modifications. The “Bush tax cuts” refers to a series of tax changes pushed through Congress by President Bush in 2003 that lowered marginal rates on earned income and reduced taxes on qualified dividends and long-term capital gains. Those cuts were schedule to expire in 2013, but the fiscal cliff deal extended them permanently for all Americans except those taxpayers with taxable income above $400,000/$450,000 (single/married filing jointly). Specifically:

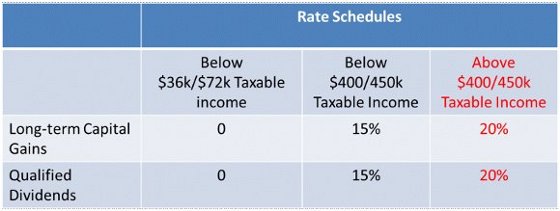

1) Capital gains. Long-term capital gains rates remain fixed at 15% for all taxpayers except those with income above the $400k/$450k threshold. (See Appendix A.)

2) Qualified dividends. The 15% tax rate for qualified dividends is likewise retained except for those with incomes above the $400k/$450k threshold. For incomes above the threshold the rate will be 20%. (See Appendix A.)

3) Tax rates. Lower tax rates on regular taxable income are retained except a new top marginal tax rate of 39.6% is established for those taxpayers with taxable income above $400k/$450k. (See Appendix B.)

Affordable Care Act (ObamaCare) Taxes

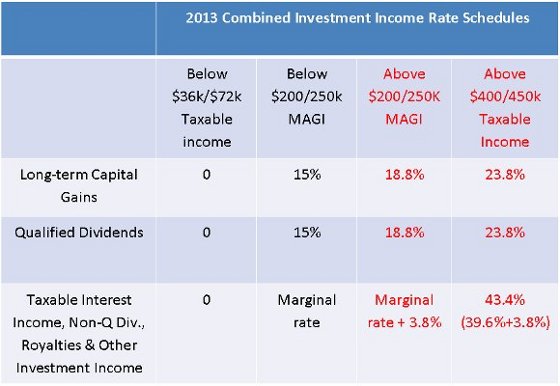

1) ObamaCare surtax. The Affordable Care Act imposes a new tax on “net investment income” (interest income, capital gains, dividends, royalties, and passive rents) of 3.8% for single taxpayers with Modified Adjusted Gross Income (MAGI) of $200,000 and $250,000 for married couples, filing jointly. (See Appendix C.)

2) Medicare tax. The Affordable Care Act also includes a rise in the Medicare tax of 0.9%, from 2.9% to 3.8%. The additional 0.9% rate applies only to those with income above $250,000 (married filing jointly).

Estate Tax

1) Estate tax. The estate tax exemption amount is fixed permanently at $5.25m with a tax rate of 40%. The exemption amount is inflation adjusted and portability is maintained.

Other Taxes

1) Deduction limitations. Limitations on itemized deductions and the personal exemption phase-out are permanently repealed for taxpayers with less than $250k/$300k Adjusted Gross Income. For those above the threshold, the old phase-outs are re-imposed.

2) Payroll tax cut. The 2010 2% cut in the payroll tax (from 6.2% to 4.2%) is reversed.

It is important to note that the thresholds for the ObamaCare taxes are not inflation adjusted. This implies that in real terms, the thresholds will decline overtime. In contrast, the tax increases resulting from the modification of the Bush tax cuts are tied to the tax table. The tax table is indexed annually for inflation. Therefore, those thresholds will remain constant in real terms over time.

American Expat Considerations

1) The 3.8% ObamaCare surtax applies to investment income no matter where the income was made and no matter where the taxpayer resided when it was realized. There has been some incorrect information disseminated in various places that the 3.8% tax would not apply to Americans residing abroad. However, the ObamaCare surtax most definitely applies to all Americans.

2) There is also some question as to whether or not the new 0.9% Medicare tax for high income earners can be avoided by taxpayers living in a country with a totalization agreement with the U.S. The answer to this is so far not clear.

3) A critical question will be whether or not the 3.8% “surtax” on investment income for high-income earners can be offset by foreign tax credits. Early indications are that they cannot be. If not, the implication is that there will be substantial double taxation of these investment income streams for high income Americans living abroad and paying local taxes on investment income.

4) The $200,000/$250,000 thresholds for the application of the 3.8% ObamaCare investment income tax apply to Modified Adjusted Gross Income (MAGI). One of the AGI modifications requires that excluded foreign earned income be added back in for to calculate income subject to the ObamaCare surtax.

5) It is important to note that the 3.8% tax on investment income does not apply to non-resident aliens. This may provide some opportunities to reduce implied tax burdens by gifting assets to family members who are not subject to U.S. taxation. (see below)

Tax and Investment Strategy Implications

Taxes are going up for all Americans, especially high income Americans, whether they live at home or abroad. This means that careful, strategic tax planning is an even more important part of American expat investment strategy. Here we describe specific investment and tax strategies that may improve long-term after-tax returns on investment for Americans abroad:

Tax Deferral

Most of the increased tax burden falls on US taxpayer with higher current income. Most of these taxpayers will only breach the thresholds that push them into the highest tax bracket and trigger the ObamaCare surtaxes during their peak, mid-career earnings years. By retirement, lower incomes will ease most of these taxpayers back into lower tax brackets. Investors thus faced heightened incentive to defer taxation on investment income to their retirement years when tax rates on that income will be lower. Therefore, American investors abroad should maximize contributions to IRAs, 401ks and company pension plans (as well as foreign retirement accounts that are “qualified” by bilateral double taxation treaties). Furthermore, the highest “current income” producing investments (bonds, high-dividend stocks, REITs, etc.) should be concentrated in these accounts. Lower current income investments (primarily stocks) should be held in taxable accounts and managed in a way that likewise defers as much income realization as possible until such time as the investor is again in a lower tax environment. These tools and investing strategies provide the necessary means to manage a properly diversified portfolio of financial assets in a strategic and tax efficient manner. Over the long run, the effect will be to significantly increase total potential wealth accumulation. The compounded and cumulative impact of rigorous year-in and year-out tax management of an investment portfolio is dramatic.

Strategic Roth Conversion

Converting traditional IRA/401k assets to Roth is an efficient way to hedge against future higher tax rates. Timing is critical, however. Conversion does not make sense for investors already in the highest tax brackets. However, for those taxpayers who anticipate higher future income tax rates, or find themselves temporarily in a lower tax bracket (such as during a year that included a period of unemployment), Roth conversion is an excellent way to lock in lower current tax rates. Accumulation of assets in Roth accounts also provides flexibility to rebalance and modify overall portfolio asset allocation as market conditions change without triggering realization of taxable capital gains by altering investments in taxable accounts.

Other Strategies

Even for those whose income in retirement will exceed the $200k/$250k ObamaCare excise tax thresholds, there are still many planning techniques that can be used to avoid the tax.

For example:

Want to help your adult children with a house down payment? Gift them appreciated stock and let them sell and realize the gain and pay the tax at their tax rates. This strategy can be expanded to all kinds of scenarios.

If a taxpayer plans to donate assets to charity, do not forget that you can leave all your highly appreciated assets to charity, get a deduction for the full market value of the asset and never pay tax on the capital gain. Do not lose this huge tax opportunity by selling in haste and paying capital gains tax that could have been permanently avoided.

Finally, highly appreciated assets left to heirs in an estate benefit from a “step-up” in basis at the time of your passing. Heirs will receive the asset with a new basis (and hence no unrealized capital gain) equal to fair market value at death. So it is important to not realize gains and pay capital gains prematurely on assets that may eventually pass to future generations free of capital gains tax.

Estate Tax Strategy

With the estate-tax exemption remaining at the relatively high level of $5.25m, not many Americans will face an estate tax issue. Furthermore, the “portability” rule effectively doubles the amount to $10.5m for couples where both parties are U.S. citizens. These thresholds, furthermore, will endure because the fiscal cliff deal on the estate tax indexes the exemption amount to inflation. However, for those families that still face and estate tax issue, a variety of relatively simple planning issues can be employed to extend significantly the amount of assets shielded from estate tax. Trusts, gifting, and generation wealth transfer are the backbone of these strategies.

For Americans abroad it is key to remember that the unlimited spousal exemption to the estate tax does not apply to spouses who are not U.S. persons. Therefore, QDOT trusts must be considered where U.S. persons are married to non-U.S. persons and estate assets exceed the exclusion amount. Furthermore, gifting to a non-U.S. person spouse may make sense. For non-U.S. person spouses, the gift tax exemption is $143,000 in 2013. If this person is also a non-resident, this may be an effective way to move assets out of the purview of U.S. taxation.

Local estate tax and inheritance laws must also be factored into the estate plan calculation for Americans abroad. The U.S. has estate tax treaties with many countries that will determine which country’s estate/inheritance tax rules apply. For cross-border, multi-nationality families, developing a viable estate plan can be exceedingly complex, even with the new, higher U.S. estate tax exemption amounts. Consult with a qualified cross-border estate lawyer.

Conclusion: Building Wealth in a Complex Cross-Border Compliance and Tax Environment

Building wealth over the long term requires much more than simply a smart portfolio strategy and proper security selection. Effective tax management and financial planning are equally important. This is especially true for Americans abroad who face a host of additional complex tax and planning issues. The urgency of tackling these issues has been accelerated by the new FATCA legislation which profound changes the investment environment for Americans abroad (see FATCA: What Americans Investors Need to Know Now available at www.thunfinancial.com).

No single investment or financial decision can be made in isolation. Effective wealth management requires a holistic integration of investment management and financial planning. Thun Financial Advisors brings together strategic investment expertise and combines it with deep a keen understanding of the unique tax and compliance environment faced by Americans abroad. With our help, our clients are making their years abroad financially enriching as well as the adventure of a lifetime.

Appendix A: 2013 Investment Income Tax Rates. 2013 “fiscal cliff” tax deal permanently extends the Bush Tax cuts with modifications. Retained tax rates shown in black with modifications shown in RED.

Effective as of January 1, 2013

Appendix B: 2013 Modified Tax Rates. 2013 “fiscal cliff” tax deal permanently extends the Bush Tax cuts with modifications. Retained tax rates shown in black with modifications shown in RED.

Effective as of January 1, 2013

Appendix C: 2013 Investment Income Tax Rates for Combined “Bush Modifications” and ObamaCare Surtax. Retained tax rates shown in black with modifications shown in RED.

Effective as of January 1, 2013

Copyright © 2013 Thun Financial Advisors

DISCLAIMER FOR THUN FINANCIAL ADVISORS, L.L.C., THE INVESTMENT ADVISOR

Thun Financial Advisors L.L.C. (the “Advisor”) is an investment adviser licensed with the State of Wisconsin, Department of Financial Institutions, Division of Securities. Such licensure does not imply that the State of Wisconsin has sponsored, recommended or approved of the Advisor. Information contained in this brochure is for informational purposes only, does not constitute investment advice, and is not an advertisement or an offer of investment advisory services or a solicitation to become a client of the Advisor. The information is obtained from sources believed to be reliable, however, accuracy and completeness are not guaranteed by the Advisor.

The representations herein reflect model performance and are therefore not a record of any actual investment result. Past performance does not guarantee future performance will be similar. Future results may be affected by changing market circumstances, economic and business conditions, fees, taxes, and other factors. Investors should not make any investment decision based solely on this presentation. Actual investor results may vary. Similar investments may result in a loss of investment capital.