The trend of seeking admission in foreign universities is on the rise all across the globe. Students from around the world are now making the decision to study overseas, even if the education system in their home country is excellent. There are numerous advantages to this, which include getting an international degree, gaining exposure to a different culture, leading a novel lifestyle, and interacting with new people. However, these benefits come at a premium and not everyone can afford to study in a foreign university.Fortunately, people who meet certain criteria can apply for a student loan, to fulfil their dreams of living and being educated overseas. At the same time, repayment of this debt can become a challenge if you are based in another country.

All students who have been given monetary aid are required to pay back their Tuition Fee loans and Maintenance loans (but not other types of student finance, like bursaries or grants). The student loan has to be paid off even by those who leave the course before the end. Do keep in mind that what you repay, the mode of repayment and the period for repayment may vary, depending on the plan you have chosen.

What repayment plans are available to students?

Depending on your circumstances, you may be required to follow any one of the two repayment plans that are offered to students, who have taken a loan to complete their graduation courses. These include:

Plan 1: This applies to English and Welsh students that started before September 1, 2012 as well as all the Scottish and North Irish students. You will start repaying the amount you owe, when you earn more than £ 17,495 (US $ 21,408; € 20,228). Please note that this amount changes every year, on April 6th.

Plan 2: This applies to all the English and Welsh students that started on or after September 1, 2012. If you opt for this plan, you will start repaying the amount you owe, when you earn more than £ 21,000 (US $ 25,705; € 24,280).

You also have the option of paying off your loan early (in full or part), without being subject to any penalties. Different plans are usually applied to postgraduate loans.

When do students start and finish repaying their loans?

The repayment of the loan will depend on a couple of factors like your specific plan, when you complete the course, when you start working, and your annual income.

If you are eligible for Plan 1, you will begin to repay the loan in the April after you graduate (or leave your course), when your income exceeds £ 17,495 (US $ 21,408; € 20,228). At any point, if your income falls below this amount, you stop paying the loan (temporarily).

If you fall under Plan 2, the earliest you start the repayment is when your annual income exceeds £ 21,000 (US $ 25,705; € 24,280). Moreover, it will either be on the first April after you complete your course or in April four years after you have started the course. However, the latter is only applicable if you are a part-time student.

What are the repayment amounts?

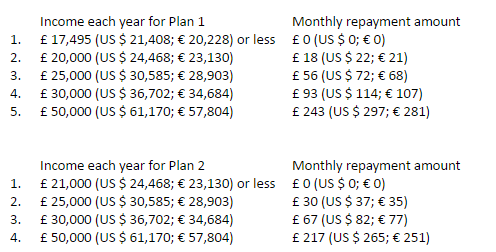

In most cases, you will be asked to pay 9% of your income over the bare minimum amount of £ 17,495 for Plan 1 and £ 21,000 for Plan 2. Given below are the monthly payments for both the plans:

The company will start adding interest to your loan from the time you get your first payment. The amount you repay depends on your plan. The current rate of interest on Plan 1 is 1.25%. For Plan 2, the interest is inflation plus 3%, while you are studying.

Depending on the number of courses you undergo, it is possible for you to have Plan 1 and Plan 2 loans. In such a case, you will still pay back 9% of your income over the minimum amount of £ 17,495. If your income is between £ 17,495 and £ 21,000, all the payments you make go only towards your Plan 1 loan. However, in case you earn more than £ 21,000, the 9% payment goes towards both your loan accounts.

How to repay a student loan

If you are working in the UK, you do not begin paying back your student loan unless you earn a certain amount. Your repayments are directly deducted from your salary, just like your taxes and National Insurance. Do mention which plan you are on at the start of your employment.

Those who are self-employed should get in touch with certain authorities to decide on a repayment plan. HM Revenue and Customs (HMRC) will look at your tax returns to determine how much you have to pay.

Repaying a student loan from overseas

The rules for paying back a student loan are more or less the same if you are working for a British company overseas. However, if you have a foreign employer, your repayments will be based on the minimum amounts of Plan 1 and 2 for that nation.

If you know that you are going to be overseas for more than 3 months, you need to complete an Overseas Income Assessment form, which will provide an estimate of your income over the next year and enable you set up a direct debit. While filing in this form, make sure that you specify the currency in which you will be paid. In addition to that, you will also be required to submit evidence of your income or means of support.

In this situation, your student loan provider will work out the amounts you have to pay back each month. They will send you a letter which:

– Confirms if your repayments are due

– Informs you about your monthly payment amounts (if applicable)

– Gives you details on arranging for direct payments

Do bear in mind that for every year you spend overseas, you will have to complete the income assessment form. The company will automatically send you the reassessment letter and form, assuming that you are based abroad.

Even when you live overseas, the monthly repayment of your loan follows the same principles. This means that you will pay 9% of your income above the threshold for the nation that you are living in. Differences in the cost of living are usually calculated, which is why the repayment threshold set for a foreign nation may be quite different from the UK. Moreover, these thresholds are updated on a yearly basis, to make provisions for price changes. They are set at an affordable level that reflects the conditions of the relevant country.

The overseas threshold is calculated based on the external data published by World Bank. The information provides a measure of differences in the overall price levels for various countries. It therefore represents the relative cost of living between countries and enables the authorities to set reasonable thresholds. In situations where the required economic information is not available, the lowest threshold is considered.

Visit the Student Loan Repayment Portal to get detailed information on the overseas earning thresholds and the minimum monthly payment for various countries.

Under normal circumstances, your scheduled repayment amount will be fixed for a period of 12 months. However, if there are any changes in your income bands, you should apply for a reassessment. This is also applicable to those who are planning to relocate to a different nation as the threshold bands are likely to vary.

However, before making any decision, it is best to speak with your student loan provider’s representative. Call +44 141 243 3660 or a reassessment or to get any of your queries answered. For accounts that are in arrears or for an income contingent repayment, contact +44 141 243 3970.

Continuing student loan repayments after returning to the UK

If you visit your home country for a short period of time, i.e. less than three months, you will still be regarded as an overseas loan re-payer by the Student Loan Company. However, if you are planning to spend more than three months in the UK, it is imperative that you let the company know about this.

If you move permanently and seek employment within the UK, your repayment status may be changed to that of a local taxpayer. Failure to update the loan company could result in double payments on your part. You could end up making a few repayments as an overseas payer via direct debit and through Pay As You Earn (PAYE) in the UK.

Lapses in payment

Not informing the Student Loan Company about moving overseas or any changes in your circumstances could cause you to incur high penalties.

Very often, people with student loans just relocate to a different country without filling out the Overseas Income Assessment Form. This is a strict no-no as it has an adverse effect on your overall credit rating within the UK. Moreover, the Student Loan Company will keep trying to contact you for the recovery of the loan amount. Remember that migrating does not write off your debt. Responsible expats find a way to pay off their student loan even from overseas.

A recent article in the Telegraph mentioned student loans as a debt that could follow a person overseas. A spokesperson for the Student Loan Company stated “Failure to keep the SLC up to date will cause the account to be placed in arrears and may incur penalty charges. If a customer fails to contact us and does not provide the necessary information, then the repayment schedule will be set up by SLC, and in most cases these payments will be much higher than expected, approximately double the average income for the country they are currently residing. We strongly advise overseas customers to keep a track on their account online by visiting www.studentloanrepayment.co.uk”.

Keeping track of repayment history

It is possible for you to check the records of your repayment schedule and balance amount through the yearly statement that will be sent to you by the Student Loan Company. Alternately, you could register for their online services to keep a tab of your payments from anywhere in the world.

Applying for a refund

You are eligible for a refund from the Student Loan Company if you have been making your repayments in spite of earning less than the minimum salary. However, to do this, you need to submit all your pay slips as well as a P60 form, which shows the tax amount you have paid on your salary in a tax year. These documents are usually provided to you by your employers. Make sure that you keep the documents safely, as you may need to apply for a refund at a later date.

There are a number of education consultants all across the UK, who guide students on the entire procedure of getting a student loan and paying it off, even when they are based in a foreign country. It is therefore best to take an appointment with a licensed expert and seek professional guidance before taking any steps.