Like much of the Western world, Germany has struggled with low birth rates. It is a problem that the country has dealt with in typical German fashion: systematically and sensibly. For decades, Germany has been developing and implementing family-focused policy in a bid to entice residents into having more children; a strategy which means that today, Germany is among the best places in the world to raise a family. Germany’s population agrees; 2016 saw the highest fertility rates in the country since 1973.Among these family policies is Kindergeld, a monthly payment the German government makes to the parents or carers of children living in the country. And yes, Kindergeld can also be claimed by expat families.

This article will explain all about the benefit, who can claim it (and who can’t), and how to apply.

What Is Kindergeld?

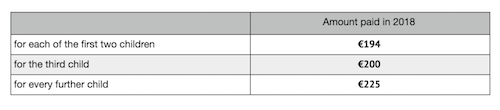

Kindergeld, or child benefit, is a standardised monthly payment made by the German government for children under the age of 18 (and up to 25 in certain circumstances), which is intended to offset some of the costs of raising a child. The amount paid is a flat sum for each child and is not affected by the parents’ or carers’ income. As of 2018, the payment is calculated as follows:

The money is not paid in cash but transferred to the bank account of the parent or carer of the child.

Who Receives Kindergeld?

Any tax-paying resident of Germany with a child in their household is entitled to Kindergeld.

As an expat, you might not have realised you are entitled to Kindergeld, but if you have a child, a residency permit, and your household pays tax in the country, then you are in luck. Even better, Kindergeld payments can be backdated for up to four years, so if you’re just finding out about this now, you haven’t missed out.

The payment goes to one person who the child lives with. Kindergeld can be claimed by:

– parents

– spouses whose stepchildren are living in their household

– grandparents whose grandchildren are living in their household

– adoptive parents

– foster parents

– guardians or carers or other persons who provide a household for a child

In the case of a shared household, be it between parents and grandparents, or a biological parent and a spouse, the person who receives the payment is decided by the family. Usually the parents take precedence for the payment. However, this can be waived in the favour of, for instance, a grandparent. The parent must inform the Family Benefit Office, who are in charge of making the payment, of any such agreements in writing. This is done through a declaration of entitlement which can be found at the end of the application form; more on that later.

If the child does not live at home, or the parents are separated and have shared custody, the parents must decide which of them will receive the benefit. If the parents cannot decide, the case will be decided by a judge in a local court.

Some families may also be able to claim Kindergeld even while they are out of the country. However, this will not apply for most English-speaking expats. You can find out more about claiming Kindergeld in cross-border cases from this government information sheet.

Recognised asylum seekers and refugees are also entitled to Kindergeld.

If you already receive child benefits from another country, state or institution that is comparable with Germany’s child benefit scheme, you are not entitled to Kindergeld. This is regardless of whether the benefits you receive are less than those in Germany.

However, this rule does not apply to family benefits given by other member states of the European Union, the European Economic Area or Switzerland, where a differential supplement as partial child benefits may be possible. More details about such cases can be found on this information sheet.

Likewise, if you do not pay tax in Germany – for instance, if you are a student or job seeker – you may not be entitled to Kindergeld. If you are not sure whether you are eligible, or have other questions, you can call the Family Benefits Office’s customer service line from Monday to Friday between 8am and 6pm on 0800 4 5555 30.

How To Apply

The filing and handling of all claims for Kindergeld is done by the Family Benefits Office (Familienkasse) of the Federal Employment Agency (Bundesagentur für Arbeit).

To apply, first download the application form www.familienkasse.de, then complete, print and sign it. You can find an English version of the form here. The application form must be submitted to the Family Benefits Office in your district, either by post or in person, along with the accompanying documentation.

Since 2016, all applications for Kindergeld require the child’s tax identification number (Steuernummer). Your child will be assigned a tax number shortly after they are born or registered in Germany, which can be found in a letter from the Federal Tax Office (Bundeszentralamt für Steuern). If you cannot find these documents, you can ask for them to be sent again at the tax office website.

You will need the following documentation:

– Your child’s birth certificate, including translations, if the document is not in German

– Your passport

– Proof of residence permit

– Proof of residency registration (Haushaltsbescheinigung)

As an expat, you will need to prove that you plan to stay in Germany long-term and that you are not receiving a similar child benefit from your home country or previous place of residence.

How Long Does It Take To Process The Application?

It usually takes between three weeks and two months for Kindergeld applications to be assessed. Once your application has been processed, you will receive a letter from the Family Benefits Office.

If your application is not accepted, the letter you receive should explain why or ask you to submit extra documentation. It is also possible to submit an appeal up to one month after your application was rejected, in order for your case to be reviewed again.

What If I Have A Change In Circumstances?

You must contact the Family Benefits Office if:

– Your family or child leaves Germany

– Your child leaves your household

– You and your spouse separate permanently or divorce

– You change your address and/or bank details

– You take up employment in the public-service sector for more than six months

My child Is Over 18 – Can I Still Claim?

Your child is entitled to Kinderzuschlag (child’s allowance) until their 25th birthday if they are:

– training for a profession, which includes university studies or vocational training

– doing voluntary service

– unemployed (cut off age 21)

– disabled (payment in this case can continue beyond 25)

More information in English can be found on this webpage from the Bundesagentur für Arbeit.

In order to continue receiving child benefits after your child is 18, additional documentation is required. You can find a list of the required documents on page 12 of this Familienkasse information sheet.

Payment Reviews

Your Kindergeld payment is subject to periodic review. If your payment is being reviewed, you will receive a questionnaire and a letter of request for information from the Family Benefit Office. These forms are intended to confirm that your family still lives in Germany and that your child is still part of your household. They may also enquire whether your child is continuing their education. You must complete these forms and attach the certifying documents to continue receiving child benefit. If you fail to do so, your Kindergeld payments will be terminated.

If you have unlawfully received child benefits, you must pay the full amount back, irrespective of culpability.

Useful Resources

This English information sheet from the Bundesagentur für Arbeit goes into extensive detail about Kindergeld, including the most economically beneficial ways for households to claim.

Additional information can be found at www.familienkasse.de or www.bzst.de.

Information about family benefits in English can be found here.

You can also call the Family Benefits Office’s customer service line between 8am and 6pm from Monday to Friday on 0800 4 5555 30.

Have you moved to Germany with children? Share your experiences in the comments below, or answer the questions here to be featured in an interview!