Being self-employed provides a level of freedom that many find attractive. But before you move to Spain and start working from a laptop on the beach, you need to make sure you’re properly registered and set up as a freelancer in the system.Below is a handy guide to the most important things you need to know before you get started.

Remember however that it may be worth retaining the services of an expert, or at the very least a translator, if you want to ensure you make no mistakes.

Registering on the system

If you wish to register yourself on Autonomos, the following steps need to be taken.

The first thing you should do is obtain your NIE number.

You will need to apply for a Tax Licence. This can be obtained from the SUMA Office in the town where your work activity will be centred, or your Town Hall (Ayuntamiento).

You will then need to complete and present an 037 form, which is stamped by the Tax Office and confirms the method of tax payment. There are two methods of paying tax:

a) You make quarterly VAT and Income Tax Declarations on the “direct estimations method”, which means you have to start double entry system book-keeping, or hire the services of an accountant, or

b) You pay a quarterly fixed income tax & VAT amount under the “modulos” system.

Both systems have their advantages; a) is a good method if you think your custom is going to fluctuate to a significant degree, as income tax & VAT is only paid on your actual profit/earnings.

Modulos payments do not take into consideration if you haven’t earned anything that month; you pay the same fixed amount regardless. Also, under the modulos system, keeping accounts or numbered VAT invoices is not compulsory. However you may well benefit from having a tax system whose payments are set at a basic level.

In order to register with the Seguridad Social (Spanish social security) system, you will need to complete and present a registration document. You will then be liable for fixed monthly payments of EUR 235. This will allow you to enjoy the Spanish national healthcare system and a pension when you retire.

You will receive a temporary card that shows your social security number. You should take this card to your local social security clinic and register with a doctor. This will instigate your permanent health card.

Further information regarding the above may be obtained from the Seguridad Social website.

If you add your spouse, partner or child they will also be entitled to medical cover. An additional “beneficiary” form must be completed, and the Marriage Certificate, Certificado de Convivencia and Birth Certificate(s), as appropriate, should be produced with the other paperwork.

Working mothers with a child under three years of age can apply for child benefit, by completing and presenting Form 140 “Deduccion por Maternidad” to the Hacienda (tax office).

If your work activity will be carried out in an office or shop where the public are allowed to enter, you will also need to make an Opening Licence application. This can be obtained from your local Town Hall.

If you require a certification to work, your original certificates must be officially translated into Spanish, and both sets forwarded to the Ministry of Education & Science. They will approve the certificates, which must then be presented with the rest of the work papers.

If you work in a bar or restaurant where food is handled, it will be necessary to sit an examination at the local Town Hall (in the form of a multi-part test), in order to obtain the requisite card allowing you to handle food. Your local Sanitas Department will also have to be notified, and they will carry out a stringent inspection of your establishment.

If your situation changes and you decide to cease self-employment it is important to inform the relevant authorities and sign off the system. Failure to do so will mean you continue to accrue payments in your name.

Accounting

Generally most people who are self-employed hire the services of a gestor or accountant who can help you register with the tax office (hacienda) as being self-employed and do the accounts both quarterly and annually. You are not obliged to maintain your records by keeping a balance sheet. You are however obliged to keep records of all your sales and business expenses.

We strongly recommend hiring an accountant to ensure the accounts are documented correctly, and even though even though you are not obliged to maintain a balance sheet, you may benefit from it as it will help you manage your business more effectively. This is especially true if the volume of transactions is high and you either buy or sell on credit.

Income tax payments

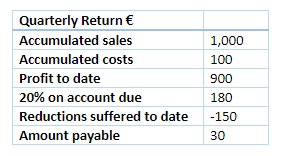

You will need to pay the tax office 20% of your profit as a payment on account of your personal tax. An example of your quarterly tax would look like this. The main benefit of this would be that you would not have huge annual bills.

Withholding tax on your sales

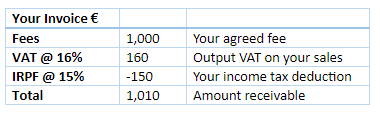

In some situations your corporate clients will be obliged to withhold some of your fees, which will then be paid over to the tax office as income tax on your behalf. Here is an example:

The standard rate of withholding tax in Spain for professional sole traders is 15%, however during your first two years you can opt for 7% retention instead. Please note for start-ups with a high volume of costs, this option will help your cash flow availability and thus increase your chances of success. However, if your cost base is low, opting for the 7% will lead to greater payments on account when the quarter comes to an end. We recommend that if your profit margins are high and you are having difficulties setting money aside to pay your taxes, it is better to suffer a 15% retention as any balancing payments due will inevitably be lower.

Year end

Once the year has come to an end, you will have to file a personal income tax return. This return will combine all of your sources of income, including your business profits, and all of the tax reliefs you are entitled to as any other resident individual.

When your final tax liability for the year has been ascertained through this process, you will either have to make a balancing payment or request a tax refund.

A balancing payment will arise if your tax liability is greater than any payments on account already made through the system noted above. Please bear in mind that the maximum payment on account will have amounted to 20% of your business profits, and that higher earners in Spain are taxed up to 43%.

A refund may be requested if the withholding tax exceeded your liability once other reliefs, such as mortgage costs, have decreased your taxable base leading to an effective rate of tax below 20%.

Have you been self-employed in Spain? Share your experiences in the comments below, or answer the questions here to be featured in an interview!