by Megan Tarr, Writer at Global Expatriate Tax Services (GETS). GETS is the official Expat Focus UK Taxation partner and is available to answer readers’ UK tax questions.

Have you recently moved abroad from the UK, perhaps to the United States? Or the Middle East? You may now be wondering: ‘am I still a UK tax resident?’ Or perhaps you have assumed you are non-resident, but you are happy to check!

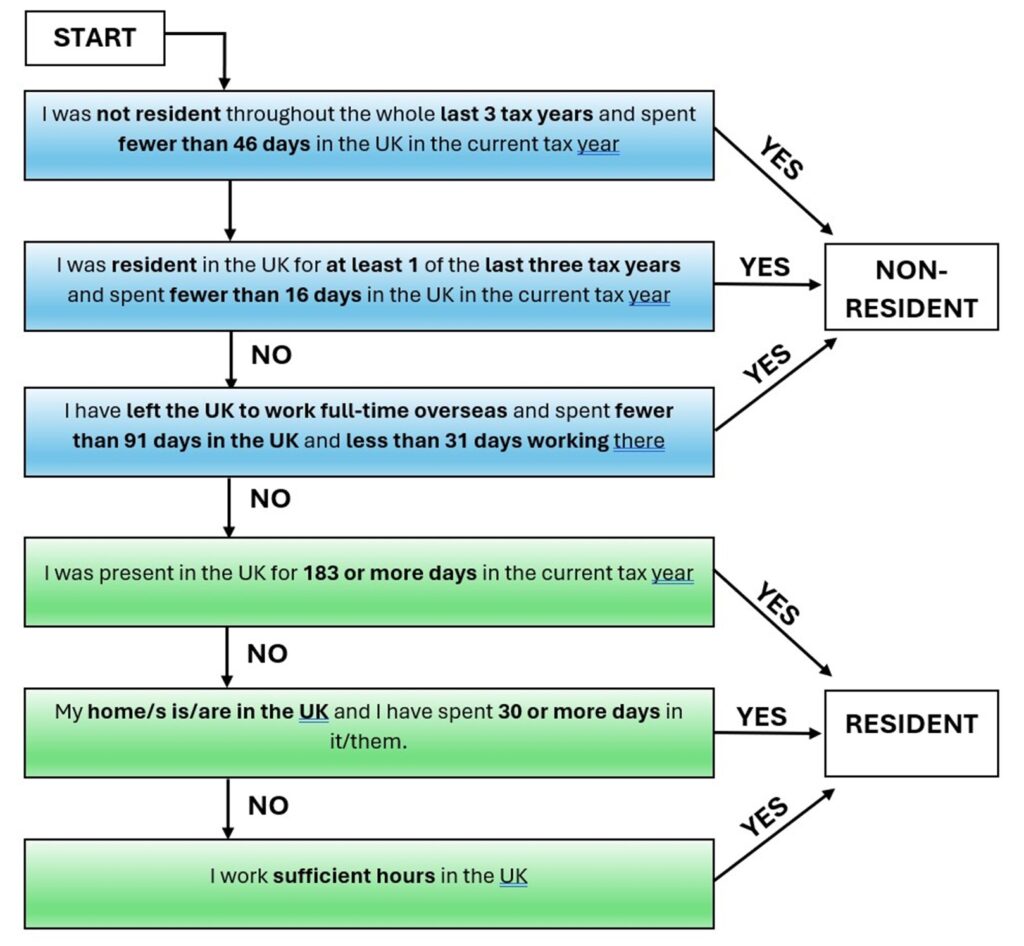

To find out your status, you will need to know and understand the basic rules for UK non-residence, which are outlined below.

This article does not cover every single UK tax law on this subject, and it is designed to be more “fun” than that. Many of the laws are also summarised to make this an easier read.

UK Tax Residence – Case Study

Before we begin, a quick story about UK tax residence:

Nick, a UK engineer who moved to the Middle East, planned to go UK tax non-resident immediately. His wife Becky was opposed to the move and therefore asked him to maximise his visits home to the UK.

In the 2022/23 tax year, Nick spent 105 days back in the UK: meeting his adult children, working here, and taking vacation. He stated that he thought he was still UK non-resident for tax. Was he, or was he in fact UK tax resident? I thought. Unfortunately, the law showed that Nick had remained UK resident for 22/23 because he failed the standard overseas tests below, and the Sufficient Ties test could not help him out. This meant that Nick’s salary would be UK taxed instead of tax-free. A cautionary tale.

Basic Rules

Automatic Overseas Tests determine your residence status for a tax year based mainly on the amount of days you spend in the UK. There are three tests:

- Automatic Overseas Tests: You are firstly automatically non-resident if you spend fewer than sixteen days in the UK (see flowchart for full rule), or secondly, 46 days if you haven’t been a UK resident in any of the last three tax years.

- Automatic Overseas Test – Working Overseas: Thirdly, you may be automatically non-resident if you work full-time overseas (i.e. at least 35 hours a week) and spend fewer than 91 days in the UK. That is the main thrust of the rule.

Sufficient Ties Test: This applies if you do not meet the criteria of the Automatic Overseas Tests. It considers any ties you may have to the UK, including family and work (also accommodation, prior UK visits, etc.). If these ties are significant, you may be considered a resident for tax purposes even if you spend less than say 91 days in the UK.

My tax tutor in accountancy school would insist that I tell you this next part so here goes: Remember: it is essential to consult with either a tax advisor like me or HMRC directly for advice regarding your tax residence status as individual circumstances may vary.

Now you know the main rules, please go through the chart below to check your resident status. Please remember that, if you fail all flow chart tests, the Sufficient Ties test can still come to your rescue.