Every Swiss resident faces the minimum monthly cost of a premium on a private health insurance policy. Healthcare cannot be accessed without it.Simply trying to stay well without insurance is not an option as health insurance is compulsory for all residents, one policy per individual, and anyone who does not voluntarily take out insurance within 90 days will be allocated to an insurer by their canton.

However, there are ways to push premiums down by fine-tuning your policy. Although all Swiss residents are guaranteed the same basic level of healthcare, costs vary from canton to canton, so saving on your premiums may begin with where you live. The Priminfo website lets you find projected premiums for all cantons for the calendar year 2020.

Choosing A Policy

There are around 60 healthcare insurance providers in Switzerland, so shopping around is always worthwhile. Comparis.ch is a helpful website for comparing them at a glance.

Only basic health insurance is compulsory, covering around 80-90% of medically necessary treatment. You can save on costs by choosing policies with a narrower range of services: for example, a restricted choice of doctor.

Another alternative is a Telmed policy, where you have to call a telephone service to be referred to a doctor or hospital. Paying a lump sum upfront will get you a discount on your annual payments. If you join a bonus insurance programme, your premium is reduced gradually for every year that you do not make any claims on your policy.

Basic policies can be topped up with optional supplementary health insurance better tailored for your specific needs, so choosing this carefully can also drive your costs down.

You can always switch to cheaper insurers, but only if you do not owe any money to your present one. Be warned that defaulters can be barred from receiving any healthcare treatment until debts are settled.

How Health Insurance Works

If you do not receive treatment then your only expense is the premium. Otherwise, you pay the costs for any treatment out of your own pocket, and are reimbursed by your insurer. The cost you are liable for is divided into two parts: deductible and excess.

Deductible

This is a one-off fixed annual contribution towards your costs. If your treatment costs less than your deductible then you pay for it in full, with no excess.

You can choose your deductible when you take out your policy, with a minimum of CHF300 for adults. Higher deductibles mean lower premiums. Children have no compulsory deductible, though parents may choose one if it helps the premiums.

Deductibles have a set range of levels, though insurers do not have to offer the full range. For adults, deductibles are CHF300, CHF500, CHF1,000, CHF1,500, CHF2,000 or CHF2,500. For children they are CHF0, CHF100, CHF200, CHF300, CHF400, CHF500 or CHF600.

Excess

This is a fixed 10% of the cost of treatment exceeding the deductible, or CHF700, whichever is lower. Your insurer pays the balance.

Example

• Your deductible is CHF300.

• You receive a medical bill for CHF400, pay this in full, and make your claim.

• Your insurer deducts your CHF300 deductible and 10% excess of the remaining CHF100: so, a total of CHF310. You are reimbursed the remaining CHF90.

• Later that year, you receive another medical bill for CHF500, which you pay yourself. You have already paid your deductible for that year, so your insurer only deducts the 10% excess, i.e. CHF50. You are reimbursed the remaining CHF450.

• As well as these costs, a stay in hospital is charged per patient at a flat rate of CHF15 per day. This is not covered by insurance.

Finding The Right Deductible

Increasing your deductible will reduce your premiums but may still lead to higher costs, as shown by the scenarios below. You can change your deductible every new calendar year. Your insurer must receive notification in writing of a reduction by 30th November and an increase by 31st December, or by the last Friday before these dates if they fall on a weekend.

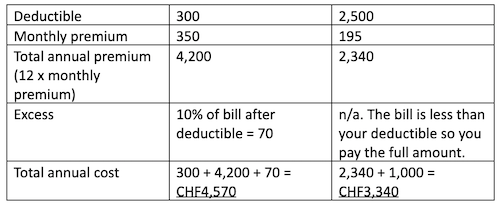

Scenario 1: annual medical bill CHF1,000

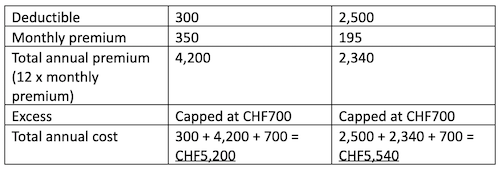

Scenario 2: annual medical bill CHF100,000

Scenario 1 shows that with a typically low annual medical bill, a higher deductible and lower premiums will save you money. Remember that a deductible is only paid if you actually need healthcare; otherwise your only outgoing is the premium.

Scenario 2 shows that with a typically high annual medical bill, you are better off with a lower deductible and higher premiums.

No one’s healthcare needs are completely predictable. Ultimately it is up to you, the customer, to find the policy that will suit you best. Insurers usually have their own online calculators to help you choose.

Remember that a medical bill includes all treatment, including non-urgent GP visits, prescription medication, and so on. These should be included in your calculations.

Exceptions

Short-term visitors to Switzerland may be exempt from compulsory basic health insurance because they are covered by international insurance packages, travel insurance or their company healthcare plan – but check with your cantonal authorities to make sure.

The only long-term exceptions for compulsory insurance are cross-border workers, retirees with a pension in another country, students with international insurance, and diplomats and their staff. All of these categories must still pay for their healthcare out of pocket, so taking out a Swiss health insurance policy may still be worthwhile.

An EHIC (European Health Insurance Card) lets short-term visitors access state-provided healthcare in Switzerland at a reduced cost.

Would you like to share your experience of life abroad with other readers? Answer the questions here to be featured in an interview!