Bermuda Bound: How to Successfully Relocate with Your Family

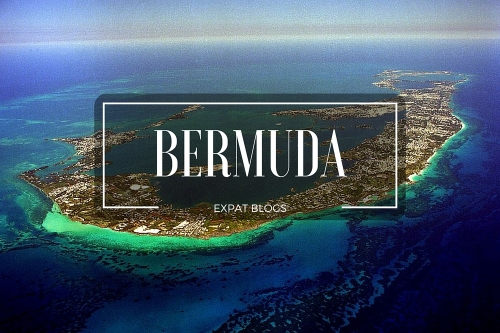

When envisioning a relocation, the azure waters and pink sands of Bermuda often seem like the stuff of dreams. Yet, the island is more than just a vacation destination – it’s a potential home, especially for those considering a family